High Potential Startup #4: MicroAcquire

Startup Acquisition Marketplace

At time of publication: Seed | Total Funds raised 6.3mn USD

*************

The cost to (and hence the downside of) starting a software or internet business has been shrinking fast especially in the past couple of decades. With billions more connected to the internet today, there is far more demand and a faster scaling opportunity.

From a funding point of view however, only a fraction of software startups get or need venture funding. The incentives of venture capital are one of extreme upside - since most startups fail, VCs need a few mega hits in their portfolio and the hence the funding and expectations are understandably towards outlier success.

For many entrepreneurs however, smaller outcomes can be life changing. A simplified example - a company earlier valued at 10mn with VC stake of 10% that sells for 20mn USD (with VC getting 2mn for their 10% and the entrepreneur getting 18mn USD for her 90% stake) is mostly a rounding error for the VC but life altering for that entrepreneur.

MicroAcquire is a solution to help such entrepreneurs who build smaller scale and bootstrapped products and want to cash out for a personally life altering amount of money. Maybe these entrepreneurs want to move on and spend their time and attention on other products. MicroAcquire is a platform that connects owners (sellers) of software startups with buyers of such startups.

An example is Fernando Rivero from Uruguay who built XmartClock, an employee time tracking app. As a solo developer, he built it alone and in 3 years was bringing in 7000 USD MRR. He wanted to move on to building other products and sold it to a buyer on MicroAcquire within 30 days of listing it on the platform.

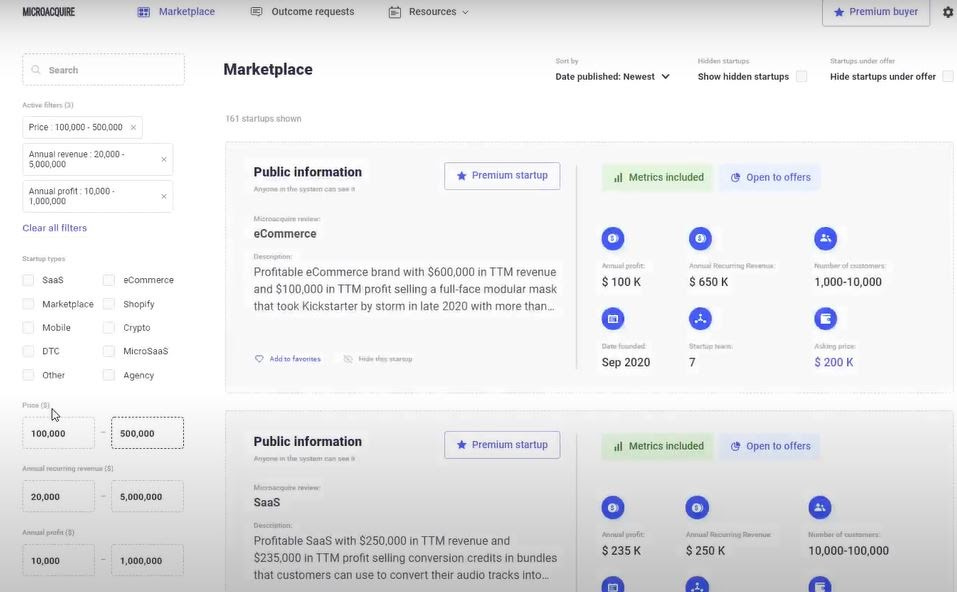

A buyer can filter based on preferences (shown on left) and view the listed products

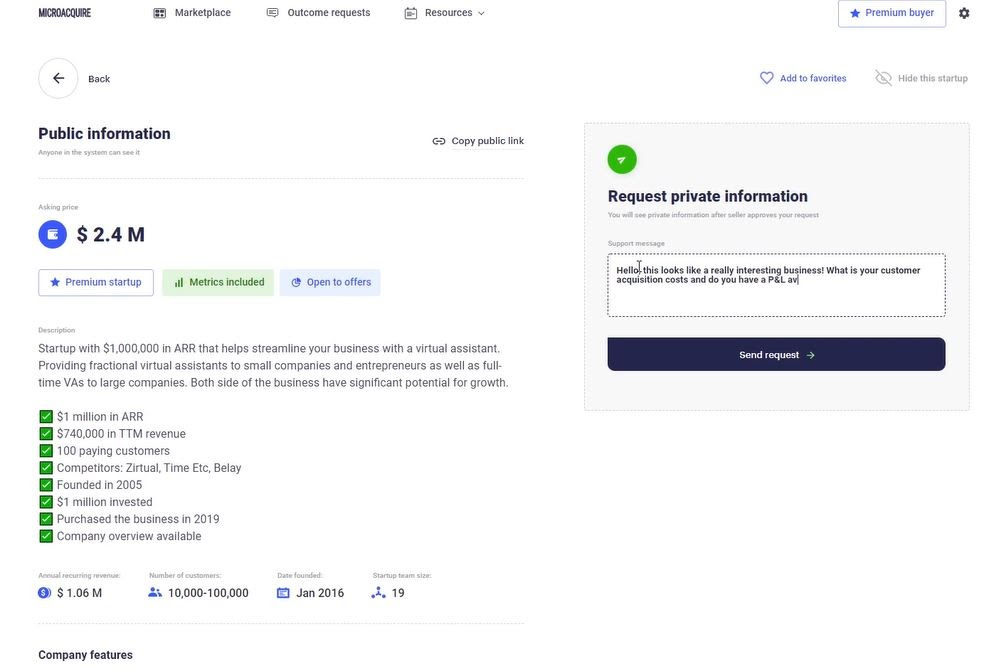

The listing is anonymous with the metrics listed. The buyer can message the seller

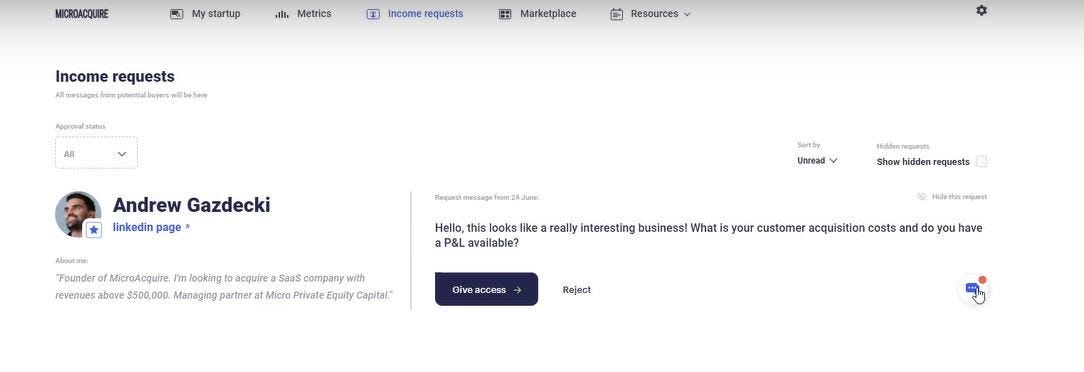

The seller can see the request, can go through the verified LinkedIn profile and decide to carry on the chat

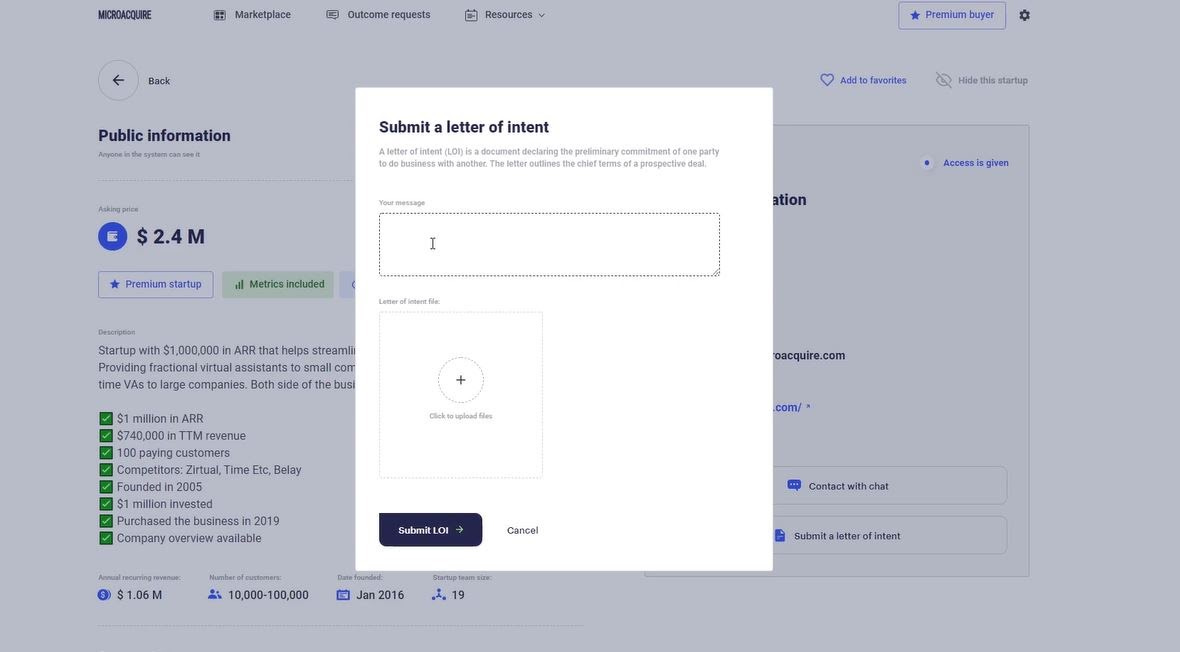

If things go well, the buyer provides a letter of intent

MicroAcquire currently mostly works with SaaS startups (often with less than 1mn USD in revenue). 300+ such startups have been sold so far on the platform.

It makes sense to start with SaaS startups since the metrics and valuation multiples are quite standardized and well known.

Metrics access is given to buyers; SaaS metrics are quite standardized

The platform is currently free to use. But it can easily be monetized (a share of transaction value). The platform promises good verification and trust and fast closure once deals are listed by simplifying the M&A process.

The platform has listings that have a combined 318mn USD in combined revenue and 60,000 registered buyers. The platform is just getting started and in my view likely has a lot of headroom to grow in micro SaaS transactions.

Small transaction sizes are a good disruptive opportunity since the alternative is an expensive, long-drawn complex search process involving banks and other players. In classic disruptive fashion, the company can later move upmarket to handle larger transactions once the workflows are perfected. MicroAcquire can also target D2C E-Commerce Brands as a big adjacent category since metrics that reveal the health of an e-commerce brand can be standardized. It is also a category where there will be a lot of M&A action.

MicroAcquire was founded by Andrew Gazdecki. And he is a pretty relentless promoter! And it is impressive that he has bootstrapped to this scale and has raised funds very recently.

Andrew Gazdecki podcast appearances past 3 months

MicroAcquire is funded by Bessemer Venture Partners and by many stellar angel investors.

A strong solution approach to an important problem, large and growing market, poor existing solutions to the problem, the potential to expand upmarket in the future and to adjacent large categories, defensibility via network effects and last but not the least a relentless founder who has bootstrapped the platform to this scale make MicroAcquire a High Potential Startup to watch out for.