Opportunity Thesis: Commoditizing Expertise

From intuition to precision and standardization

Initially, solving problems require a lot of intuition and expertise. But over time, the amount of expertise required to solve the problem reduces through a combination of standardization of processes and intervention of technology.

This has played out again and again in many industries. Let us consider a few examples:

Clothing: Centuries before you needed skill and expertise to make clothing. Handlooms and later factories started coming up and standardized the cloth making processes. While earlier, expensive artisans used to make clothes, now clothing factories are highly mechanized. Fashion Trend forecasting was highly intuition based but nowadays Shein, Zara and other fast fashion players are proving that a ton of data can help automate this.

Cooking: Food preparation requires some expertise and intuition. Great riches have been made by removing the need for expertise. Take McDonalds and Chipotle - they have standardized the processes so much that one needs little training to be a cook there. And instant noodles takes this further - a great do-it-yourself innovation which ensures you don’t need any expertise at all! 45bn$ worth of instant noodles were sold in 2020.

Shopping Websites: Designing websites on your own takes expertise and probably many months of training. A small business owner trying to sell online cannot invest her time in designing her own website. Shopify has commoditized this and has turned opening an online store into a 10-min standardized activity. Last I checked, Shopify has a market cap of more than 200bn$!

Lending: While evaluating a borrower required intuition a few decades back, the introduction of FICO scores in 1989 transformed credit scoring into a standardized non-intuitive process. The FICO corporation today sells 10bn credit scores every year and is used by 90% of the top lenders in the US and earns more than 1.3bn$ in revenue every year.

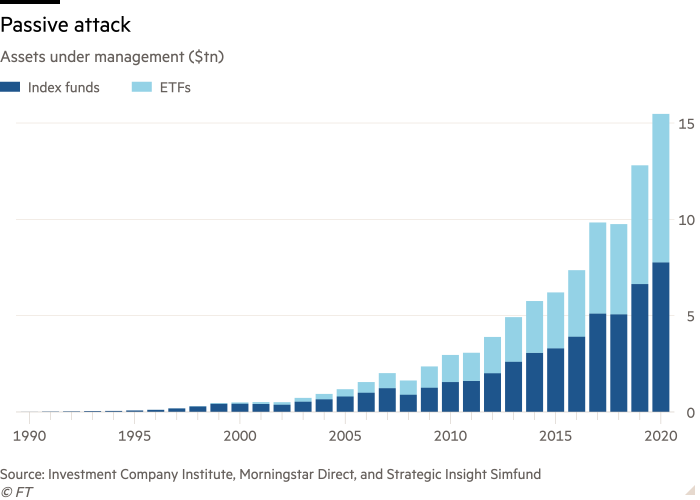

Investing: Passive funds which outperform most (higher fee) active investment funds have transformed the investing landscape from the time it was introduced in 1970s and today we have trillion dollar passive asset managers like Vanguard and Blackrock.

Real Estate Valuation: What is your home worth? Answering this question will take a lot of intuition. Zillow’s Zestimate with data on 110mn homes across the United States commoditizes this. Today it is as simple as entering your address and getting an instant answer. Zillow claims a median error rate of 1.9% for on-market homes.

Commoditizing expertise and intuition is great for society. Why?

Expertise and Intuition are inherently scarce and expensive. Technology intervention and standardization of processes can help in scaling and increasing access to solutions.

And when Expertise and Intuition are involved, quality is inconsistent among solution providers. When solutions that commoditize expertise become just ‘good enough and consistent’, then customers will flock to it.

There are a few ways this standardization and commoditization of expertise happens:

1. Providing a good enough low-frills product by simplifying processes which can be served at lower costs. McDonalds is a good example of this - a limited menu with standardized processes helps with lower costs but also a consistent experience. Shopify will probably not give you the best e-commerce product but it helps you create a good enough shopping website at low cost and start selling in minutes. Instant Noodles and Index Investing are other examples.

2. There is enough data to infer rules (probably via AI) that enables a low-cost solution that is good enough compared to the best intuition money can buy. Credit scoring, Zestimate (mentioned above) and Insurance underwriting are some examples.

3. Increasing the productivity of experts by limiting their role to performing the most intuitive tasks and outsourcing other tasks to inexpensive non-expert labor. Aravind Eye Care hospital in India is an interesting example of this. The hospital revolutionized eye operations in the country by taking a McDonalds-like (the founder was actually inspired by McDonalds) assembly line approach to operations - the cataract removal process was rethought from first principles and most of the work is done by inexpensive but well trained paramedical professionals.

50% of its patients receive services either free of cost or at steeply subsidized rate, yet the organization remains financially self-sustainable. Much importance is given to equity – ensuring that all patients are accorded the same high quality care and service, regardless of their economic status. A critical component of Aravind’s model is the high patient volume, which brings with it the benefits of economies of scale. Aravind’s unique assembly-line approach increases productivity tenfold. Over 4.5 lakh eye surgeries or procedures are performed a year at Aravind, making it the largest eye care provider in the world. Since its inception, Aravind has handled more than 6 crore ( 65 Million) outpatient visits and performed more than 78 lakh (7.8 million) surgeries.

4. In some cases, human intuition can be completely replaced by machines due to the sheer amount of data and computing ability. Think of Google Maps providing the route that takes the least amount of time possible. The best Chess engines are already way better than the world chess champion.

There are some big startup opportunities in commoditizing expertise.

Some Interesting Opportunities by Commoditizing Expertise

Consulting and Advice: The internet abounds with tons of information about any topic. There is probably an opportunity for a software platform to algorithmically curate relevant pieces of content (data, tables, graphs, essays etc.) on any topic and highlight relevant passages and data that can be useful for clients. The big consulting companies are not scalable and frankly take a lot of time to arrive at answers. There is hence a big opportunity to build good enough ‘advice/consulting’ solutions.

Law and Justice: The legal systems in many countries are clogged. In India for example, more than 40mn cases are pending. Getting justice is often expensive for the poor. We can get faster (and wider) justice by commoditizing expertise of lawyers and judges. There are potential software opportunities in: discovering more cases where there is potential wrong doing; quickly evaluating the merits of a case; enabling almost anyone to construct good arguments; highlighting important facts and arguments to help judges accelerate judgements etc. For example, Clearbrief helps lawyers analyze the strength of their arguments in every sentence they write.

Venture Capital: VCs are rewarded for their intuition - identifying new areas of opportunity, sourcing and filtering the right startups, portfolio construction, figuring out the appropriate price and ownership stake etc. They are paid 2% management fee every year and 20%+ of profits as carry. As an asset class though, most VCs don’t beat the benchmark equity index. There is potentially an ‘indexing’ approach to venture investing - investing in hundreds of early stage startups with a standard investment stake and standard valuation with decision to invest or not in a startup made in a few days. For the startups, this means less time spent in fundraising and more time spent talking to customers and getting to product-market fit.

Hiring: Hiring is intuitive and employers have to rely on ‘proxies’ like credentials and networks for judgement and to filter talent. In an ageing world with a shortage of skilled talent there can be other approaches. For example, there can be a marketplace of talent ‘scouts’ - industry practitioners who can review, interview and recommend and grade talent. This evaluation process can be standardized via technology to ensure the scouts capture many signals. For example, the interview intelligence startup Brighthire.ai helps companies run structured interviews that can be replayed and analyzed. On the talent side, there will be demand from job seekers to move away from credentialing as a key requirement (whether someone studied or worked in a highly popular place) and to provide a fair platform where job seekers can prove their skills. In an increasingly remote working world, such approaches will help hire faster and better.

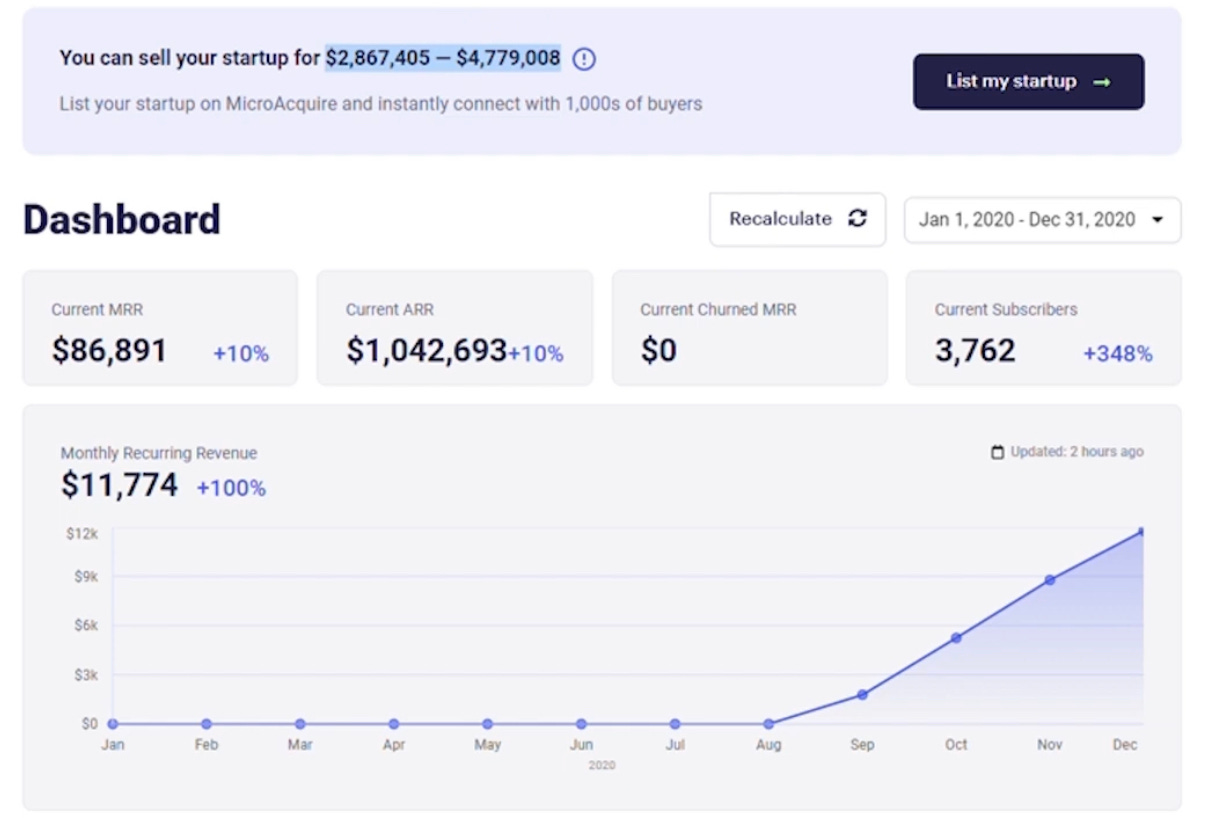

M&A: M&A transactions take far too long with lots of fees paid to banks and services firms that manage the transactions. There could be a way to standardize the identification, sourcing and diligence processes. Standardizing processes means lower overhead cost in closing a transaction which means buyers can do smaller ticket size M&A transactions and for sellers there is an opportunity to exit at lower but meaningful (and life changing) transaction sizes. For example, MicroAcquire is a fast growing startup that does this with SaaS businesses. There is a standard acquisition template with standard metrics and processes and many small businesses have exited with life changing outcomes. SaaS startups can even check their potential exit value as shown below.

Similarly OpenStore evaluates and makes an offer for your e-commerce business within 24 hours. All you have to do is enter your store website.

Healthcare: Medical education takes years and years of training and doctors are hence expensive and scarce. Access to quality healthcare can be expanded by increasing productivity of doctors - can a large part of the processes involved in diagnosis and care be automated or outsourced to trained but inexpensive paramedical professionals? Less acute cases can be a good starting point.

Mental Health: There is growing demand for mental health solutions as awareness about mental health grows and taboos around it decrease. But the care delivered is very intuitive and quality may vary widely. There is probably potential to standardize quality here. For example, the UK startup Ieso is trying to automate mental health therapy basis ten years of real-life text-based conversations between patients and therapists.

Nutrition: We hear about celebrities having personal nutritionists. What if everyone can have a low-cost but high quality ‘nutritionist’ in their pocket? For example, think of an app that can help track your cravings and help nudge you to eat right; provide the right food options; ‘scan’ the calories and estimate the nutrition on your plate etc.

Government Welfare Spending: Governments cumulatively spend many trillions of dollars every year on welfare. What they spend on and how efficiently they can spend can impact billions of people. But the spending decisions are highly intuitive and based on political calculations. Standardizing the decision making on “where to spend?”, “on what to spend?” and “how much to spend?” can result in far better outcomes for a country’s citizens. This can probably be done by using AI on the tons of data that is being generated (high satellite imagery, industry data, surveys, volunteer data, consumption transaction data, drone imagery etc.). In the future we can even probably automate welfare spending and make it very impactful and equitable.

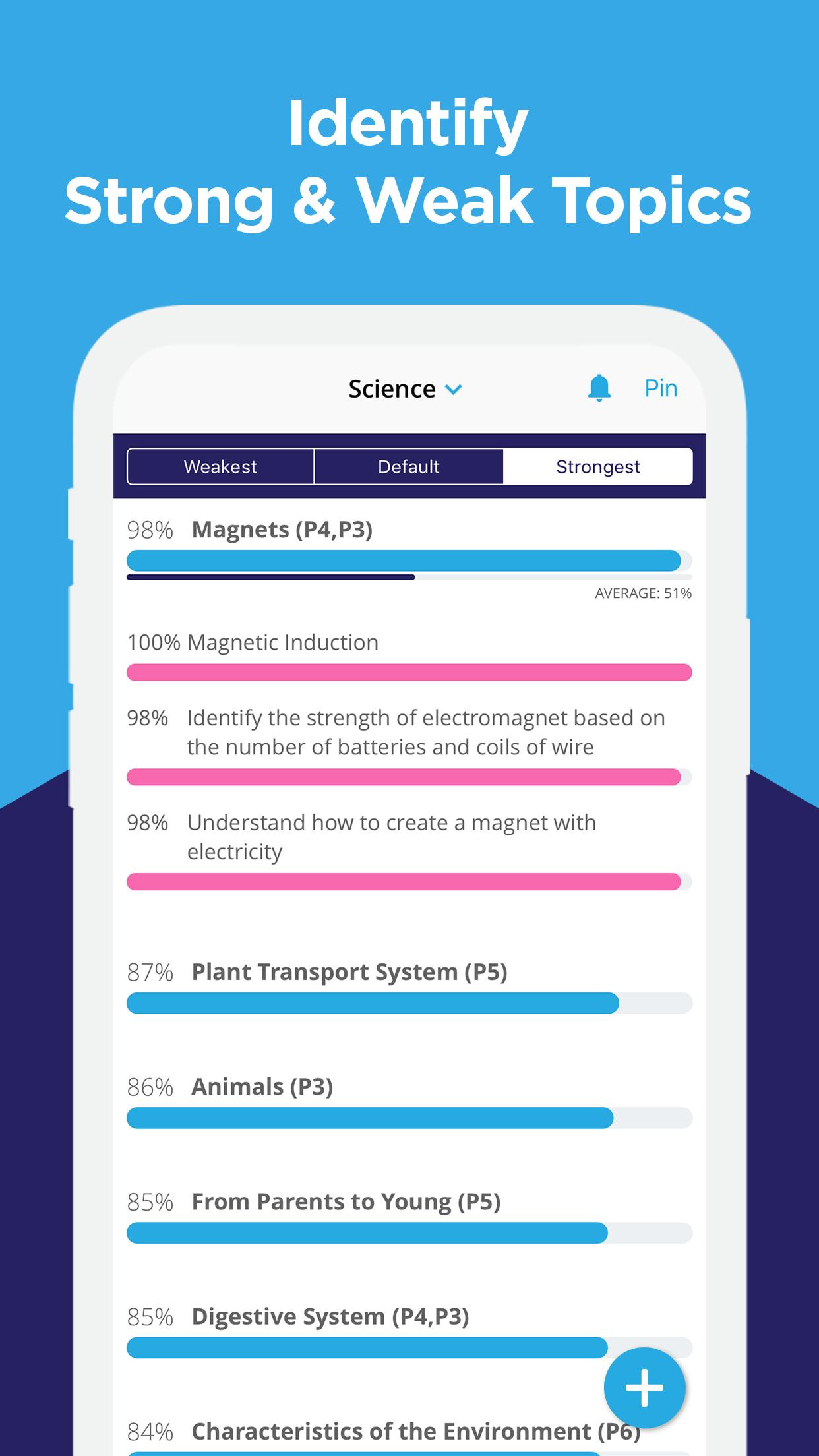

Education: Many parts of the Education journey are very intuitive - admission decisions, evaluating a student’s learning needs, curriculum design, assessments etc. Automating some of these can help drive down costs significantly and can lead to better learning outcomes. For example, Geniebook uses AI to identify weak areas of a student and personalizes practice and learning.

We can build and expand access to transformative solutions by commoditizing expertise and intuition and I believe we will see such solutions in this decade with advances in AI and related technologies and as data generated accelerates.